Banger Casino Bangladesh: নিবন্ধের বিস্তারিত পর্যালোচনা

Banger Casino Welcome Bonus – 125% বোনাস সহ 250 ফ্রি-স্পিন নতুন খেলোয়াড়দের জন্য

Banger Casino – এটি একটি অনলাইন ক্যাসিনো প্ল্যাটফর্ম যেখানে

ব্যবহারকারীরা মোবাইল অ্যাপ অথবা ডেস্কটপ থেকে খেলা চালাতে পারেন এবং প্রকৃত মুদ্রায়

লেনদেন করতে পারেন।

এই প্ল্যাটফর্মটি আইনগতভাবে পরিচালিত এবং বাংলাদেশ, ভারত, তুরস্ক সহ অন্যান্য দেশসমূহে

কার্যকর। আমাদের ওয়েবসাইট এবং অ্যাপের মাধ্যমে বিভিন্ন ধরণের খেলা উপলব্ধ রয়েছে, যা

খেলোয়াড়দের তথ্যবহুল ও সহজবোধ্য বিনোদন প্রদান করে।

এই নিবন্ধে আমরা Banger Casino-এর নিবন্ধন, জমা ও উত্তোলনের পদ্ধতি, গেমের ধরণ, লাইভ

ক্যাসিনো সেবা, মোবাইল সংস্করণ এবং অন্যান্য বৈশিষ্ট্য নিয়ে বিস্তারিত আলোচনা করব।

| ⚡️ প্রতিষ্ঠার বছর | 2024 |

| 📍 মালিক | Bang Casino Inc. |

| 🌍 উপলব্ধ দেশসমূহ | ৩০+ |

| ✅ লাইসেন্স প্রদানকারী | Curacao |

| 💻 অফিসিয়াল ওয়েবসাইট | https://banger.casino/ |

| 💰 পেমেন্ট পদ্ধতি | BKash, Nagad, Rocket Pay, Visa, Mastercard |

| 📲 মোবাইল অ্যাপ | হ্যাঁ, Google Play-এ উপলব্ধ |

| 📞 কাস্টমার সাপোর্ট | ইমেইল, লাইভ চ্যাট |

| 🌐 ভাষাসমূহ | EN, BN, KZ, MM, SI, AZ |

| 🎯 গেম সংগ্রহ | ১৫০০০+ |

| 🎰 গেমের ধরণ | Crazy Time, স্লট, রুলেট, পোকার, ব্ল্যাকজ্যাক, ব্যাকারাট, স্ক্র্যাচ কার্ড, ইন্সট্যান্ট গেম, আর্কেড গেম, ডাইস গেম, লটারি, গেম শো |

| 🎁 Welcome Bonus | 125% বোনাস + 250 ফ্রি স্পিন |

| ⚙️ দায়িত্বশীল গেমিং সাপোর্ট | BeGambleAware |

| 🚀 জনপ্রিয় খেলা | Aviator, Crazy Time |

| 💸 নূন্যতম জমা | ৳500, USD 5, TRY 80, INR 300, RUB 200, KZT 240 |

| ⚽️ স্পোর্টস বেটিং | E-sports, ভার্চুয়াল স্পোর্টস এবং সাধারণ ক্রীড়া |

Banger Casino – নিবন্ধন ও লগইন প্রক্রিয়া

- ১) Banger Casino এর ওয়েবসাইট পরিদর্শন করুন।

- ২) পেজের উপরের অংশে স্লাইডারের মাধ্যমে ক্যাসিনোর সম্পর্কে প্রাথমিক তথ্য প্রদর্শিত হয়, যেখানে লোগো, মেনু, গেম সংগ্রহের লিঙ্ক এবং নিবন্ধন ও লগইন বাটন রয়েছে।

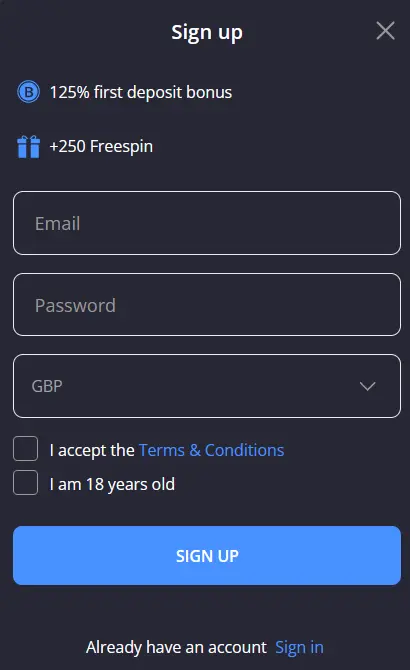

- ৩) উপরের ডানদিকে "নিবন্ধন করুন" বাটনে ক্লিক করে নিবন্ধন প্রক্রিয়া শুরু করুন। প্রথম ধাপে আপনি Welcome Bonus নির্বাচন করতে পারবেন।

- ৪) নিবন্ধন ফর্মের পরবর্তী ধাপগুলোতে আপনার বেসিক তথ্য, যেমন ইমেইল, নাম এবং ঠিকানা প্রদান করতে হবে।

- ৫) ফর্ম পূরণ শেষে, আপনার ইমেইল যাচাই করতে বলা হবে যাতে অ্যাকাউন্ট সক্রিয় করা যায়।

- ৬) যাচাই প্রক্রিয়া সম্পন্ন হওয়ার পর, নতুন অ্যাকাউন্ট দিয়ে ওয়েবসাইটে লগইন করুন।

- ৭) প্রথম জমা পরে, আপনার পছন্দের খেলা চালু করুন এবং প্ল্যাটফর্মের সেবা উপভোগ করুন।

জমা ও উত্তোলন – Banger Casino Bangladesh

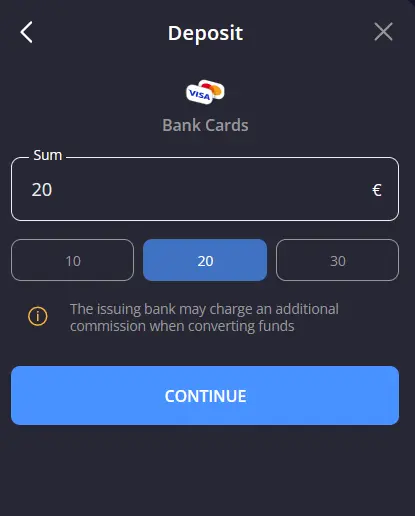

নিবন্ধনের পরে, খেলা শুরু করার জন্য প্রথম জমা প্রদান অপরিহার্য। Banger Casino-তে জমা প্রদান ও উত্তোলনের মাধ্যমে ব্যবহারকারীরা সরাসরি লেনদেন করতে পারেন।

আপনি ফিয়াট মুদ্রা এবং ক্রিপ্টোকারেন্সি উভয় মাধ্যমেই জমা প্রদান করতে পারবেন।

| পেমেন্ট অপশন | BKash, Nagad, Rocket Pay, Visa, Mastercard |

| নূন্যতম | সর্বোচ্চ | |

| জমা | 400 BDT | 20,000 BDT |

| উত্তোলন | 1,000 BDT | 20,000 BDT |

Banger Casino-তে বিভিন্ন ধরনের খেলা

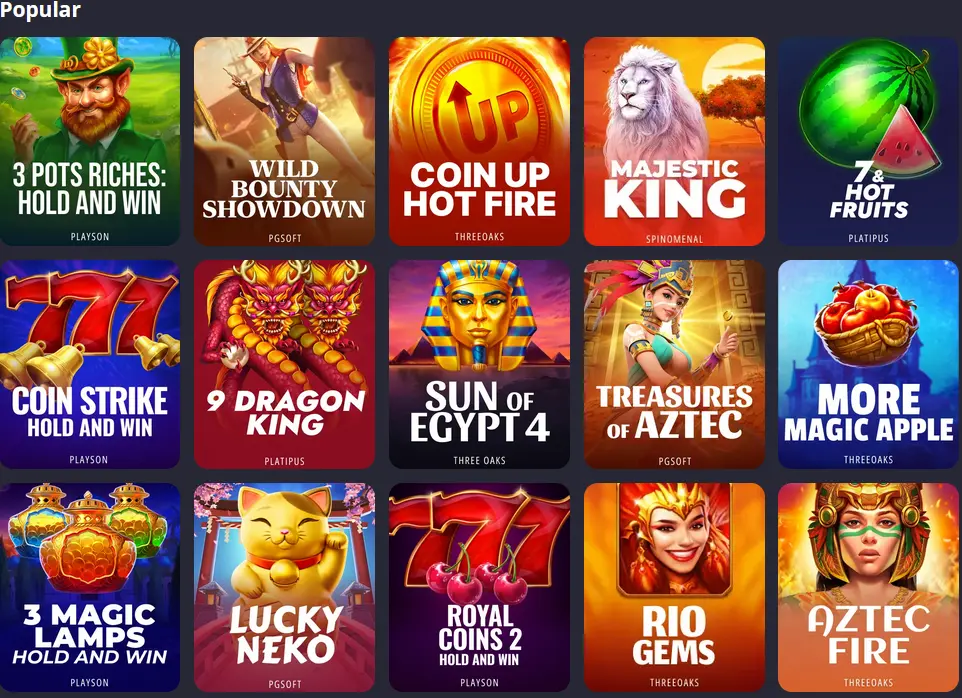

Banger Casino-তে বিভিন্ন বয়সের জন্য খেলার ব্যবস্থা রয়েছে। প্ল্যাটফর্মটিতে এমন গেমসেট আপলোড করা হয়েছে যা বিভিন্ন খেলোয়াড়ের আগ্রহ ও পছন্দ অনুযায়ী সাজানো। এখানে স্লট, টেবিল গেম, পোকার, রুলেট, ব্ল্যাকজ্যাক, ব্যাকারাটসহ আরও অনেক ধরনের খেলা রয়েছে। প্রতিটি খেলার বিস্তারিত নীতিমালা, রুল এবং অর্থনৈতিক লেনদেনের পদ্ধতি স্পষ্টভাবে উপস্থাপন করা হয়েছে যাতে খেলোয়াড়রা সহজে বুঝতে পারেন।

Banger Casino Aviator

বর্তমান সময়ে Banger Casino-তে Aviator নামক খেলা প্রসারিতভাবে খেলা হচ্ছে। এই ক্র্যাশ গেমটি নির্দিষ্ট সময়ের মধ্যে বাজি রাখা ও ফলাফল অনুযায়ী বেতন প্রদান করে। খেলোয়াড়রা খেলার নিয়মাবলী মেনে যাত্রা করে এবং প্রদত্ত নির্দেশাবলী অনুসরণ করে অংশগ্রহণ করতে পারেন। এই খেলার মাধ্যমে অংশগ্রহণকারীরা গণিতের উপর ভিত্তি করে ফলাফল সম্পর্কে ধারণা করতে সক্ষম।

লাইভ ক্যাসিনো

Banger Casino Bangladesh-এ লাইভ ক্যাসিনো বিভাগে খেলোয়াড়রা সরাসরি ডিলারের সাথে খেলার অভিজ্ঞতা লাভ করতে পারেন। এই বিভাগে প্রতিটি খেলা একটি নির্দিষ্ট টেবিল এবং ডিলারের সহযোগিতায় পরিচালিত হয়। লাইভ গেমিং সেশনে অংশগ্রহণকারীরা বাস্তব সময়ে সিদ্ধান্ত নিতে পারেন এবং খেলার নিয়মাবলী অনুসরণ করে অংশ নিতে পারেন।

লাইভ ক্যাসিনো বিভাগটি এমনভাবে ডিজাইন করা হয়েছে যাতে ব্যবহারকারীরা সহজেই খেলা শুরু করতে পারেন। খেলোয়াড়রা বিভিন্ন ধরনের টেবিল নির্বাচন করে, যেমন ব্ল্যাকজ্যাক, রুলেট, ব্যাকারাট অথবা পোকার খেলতে পারেন। প্রতিটি টেবিলে খেলার নিয়ম, বাজির পরিমাণ এবং অন্যান্য শর্তাবলী স্পষ্টভাবে উল্লেখ করা থাকে।

Crazy Time – Banger Casino

Crazy Time খেলা Banger Casino-তে উপলব্ধ এবং এটি বর্তমান সময়ে বাংলাদেশে বেশ পরিচিত। এই খেলাটির নিয়ম সরল এবং অংশগ্রহণকারীরা সহজেই বাজি রাখার পদ্ধতি মেনে খেলা চালিয়ে যেতে পারেন। খেলোয়াড়রা নির্দিষ্ট সময়ের মধ্যে ফলাফল অনুসারে বেতন ও পুরস্কারের হিসাব দেখতে পান।

মোবাইল সংস্করণ

Banger Casino প্ল্যাটফর্মটি ডেস্কটপ এবং স্মার্টফোন উভয় ব্যবহারকারীর জন্য উপলব্ধ। মোবাইল ফার্স্ট অ্যাপ্রোচ অনুসরণ করে তৈরি এই সাইটটি HTML5 প্রযুক্তির মাধ্যমে অপ্টিমাইজড করা হয়েছে, যার ফলে মোবাইল ব্রাউজারে খেলার অভিজ্ঞতা নির্বিঘ্ন হয়। ওয়েবসাইটে দ্রুত লোডিং সময় এবং স্বয়ংক্রিয়ভাবে সব ডিভাইসে কাজ করার সক্ষমতা লক্ষ্য করা যায়।

মোবাইল ব্যবহারকারীদের জন্য Banger Casino-এর অ্যাপ্লিকেশন প্রদান করা হয়েছে, যা APK ফাইলের মাধ্যমে ডাউনলোডের সুযোগ পাওয়া যায়। ব্যবহারকারীরা সরাসরি মোবাইল ব্রাউজার থেকে ক্যাসিনোর সুবিধা গ্রহণ করতে পারেন এবং তাদের পছন্দের খেলা শুরু করতে পারেন।

গেম লাইসেন্সিং

Banger Casino প্ল্যাটফর্মে ১,০০০ এর অধিক গেম উপলব্ধ। এই খেলাগুলো স্লট মেশিন, টেবিল গেম, ভিডিও পোকার, রুলেট, ব্ল্যাকজ্যাক, স্ক্র্যাচ কার্ড, পোকার, বিংগো, ভার্চুয়াল স্পোর্টস, আর্কেড গেম, কেনো, ফ্ল্যাশ গেম এবং জ্যাকপট গেম সহ বিভিন্ন বিভাগে বিন্যস্ত। প্রতিটি গেমের সাথে সংশ্লিষ্ট নিয়মাবলী এবং অর্থনৈতিক লেনদেনের পদ্ধতি স্পষ্টভাবে উল্লেখ করা হয়েছে যাতে খেলোয়াড়রা যে কোনো ধরণের খেলা নির্বিঘ্নে উপভোগ করতে পারেন।

গেম সরবরাহকারীদের সাথে সহযোগিতার মাধ্যমে Banger Casino একটি বিস্তৃত গেম সংগ্রহ প্রদান করে। এই সরবরাহকারীরা তাদের নিজস্ব নির্ধারিত মান অনুসরণ করে এবং খেলোয়াড়দের জন্য নিরপেক্ষ এবং সঠিক তথ্য প্রদান করে। এর ফলে, প্ল্যাটফর্মে যে কোনো খেলোয়াড় সহজে তাদের পছন্দ অনুযায়ী খেলা নির্বাচন করতে পারে।

Banger Casino-এর এই নিবন্ধে আমরা প্ল্যাটফর্মের বিভিন্ন দিক যেমন নিবন্ধন প্রক্রিয়া, জমা ও উত্তোলনের নিয়ম, মোবাইল সংস্করণ ও লাইভ গেমিং বিভাগসহ অন্যান্য গুরুত্বপূর্ণ বিষয়গুলোর বিস্তারিত আলোচনা করেছি। এই নিবন্ধের মাধ্যমে পাঠকরা সাইটের কার্যপদ্ধতি, গেমের বৈচিত্র্য এবং লেনদেন সংক্রান্ত বিষয়গুলো সম্পর্কে স্পষ্ট ধারণা লাভ করতে পারবেন। নিবন্ধটি এমনভাবে তৈরি করা হয়েছে যাতে সকল ব্যবহারকারী সহজেই বুঝতে পারে এবং প্রয়োজনীয় তথ্য সংগ্রহ করতে পারে।

নিবন্ধের এই অংশে আমরা আরও বিশদে আলোচনা করেছি কিভাবে সঠিকভাবে নিবন্ধন সম্পন্ন করবেন এবং জমা ও উত্তোলনের ক্ষেত্রে কি কি নিয়মাবলী মেনে চলতে হবে। ব্যবহারকারীদের ব্যক্তিগত তথ্য সুরক্ষা, ইমেইল যাচাই, এবং লেনদেন পদ্ধতির সঠিকতা রক্ষার জন্য Banger Casino উপযুক্ত ব্যবস্থা গ্রহণ করেছে। প্রতিটি ধাপে নির্দেশনা প্রদান করা হয়েছে যাতে নতুন ব্যবহারকারীরাও যেন কোন অসুবিধা ছাড়াই এই প্ল্যাটফর্মের সুবিধা গ্রহণ করতে পারেন।

Banger Casino-তে খেলার ধরন অনুযায়ী বিভিন্ন বিভাগ রয়েছে। প্রতিটি খেলার বিভাগে গেমের নিয়ম, বাজির পরিমাণ, এবং নির্ধারিত সময়সীমা উল্লেখ করা আছে। ব্যবহারকারীরা চাইলে টেবিল গেম থেকে শুরু করে স্লট, পোকার এবং অন্যান্য খেলার নিয়মাবলী বিস্তারিতভাবে বুঝতে পারেন। এইভাবে, তাদের বিনোদনের সাথে সাথে সেই খেলার উপর ভালো ধারণা তৈরি হয় যা পরবর্তীতে সিদ্ধান্ত গ্রহণে সাহায্য করে।

প্ল্যাটফর্মের মোবাইল সংস্করণটি এমনভাবে তৈরি করা হয়েছে যাতে স্মার্টফোন ব্যবহারকারীদের জন্যও একই রকম কার্যকারিতা নিশ্চিত করা যায়। Banger Casino-এর মোবাইল অ্যাপ্লিকেশন ও ওয়েবসাইট ব্যবহার করে যে কোনো জায়গা থেকে খেলা শুরু করা সম্ভব। মোবাইল ব্রাউজারে সহজে প্রবেশযোগ্য এই সাইটে দ্রুত লোডিং সময় এবং সহজ নেভিগেশন নিশ্চিত করা হয়েছে। অতিরিক্তভাবে, ব্যবহারকারীরা ইন্টারনেট সংযোগ থাকলেই নির্বিঘ্নে সকল সেবার সুবিধা গ্রহণ করতে পারেন।

এই নিবন্ধের মাধ্যমে আমরা Banger Casino-এর কার্যপ্রণালী, ব্যবহারকারীদের জন্য নির্ধারিত নিয়মাবলী এবং গেমিং সিকিউরিটি ব্যবস্থা সম্পর্কে বিস্তারিত আলোচনা করেছি। নিবন্ধটি এমনভাবে লেখা হয়েছে যাতে এটি সকল ব্যবহারকারীর জন্য তথ্যবহুল এবং বোধগম্য হয়। Banger Casino প্ল্যাটফর্মের এই নিরপেক্ষ আলোচনা ব্যবহারকারীদের নিজস্ব বিনোদন পদ্ধতি নির্ধারণে সহায়ক ভূমিকা রাখতে পারে।